single life annuity with 10 years guaranteed

Single life male 10 year guarantee Financial Institution Age in Years. Means a reduced monthly benefit compared to the Single Life Only Annuity payable to the Participant for his or her lifetime.

What Is A Single Life Annuity Definition And Payout Option

Payments can be made over one life or two lives as guaranteed lifetime payments and can include beneficiary.

. A life annuity with period certain is a hybrid option that provides lifetime payments with guaranteed income for a specified number of years. It is insulated from the market booms and busts. This income would be paid to you but can pass to a named beneficiary when you.

With this annuity the insurance company promises to. If you were to pass away during the first year payments would. If not that is not the case.

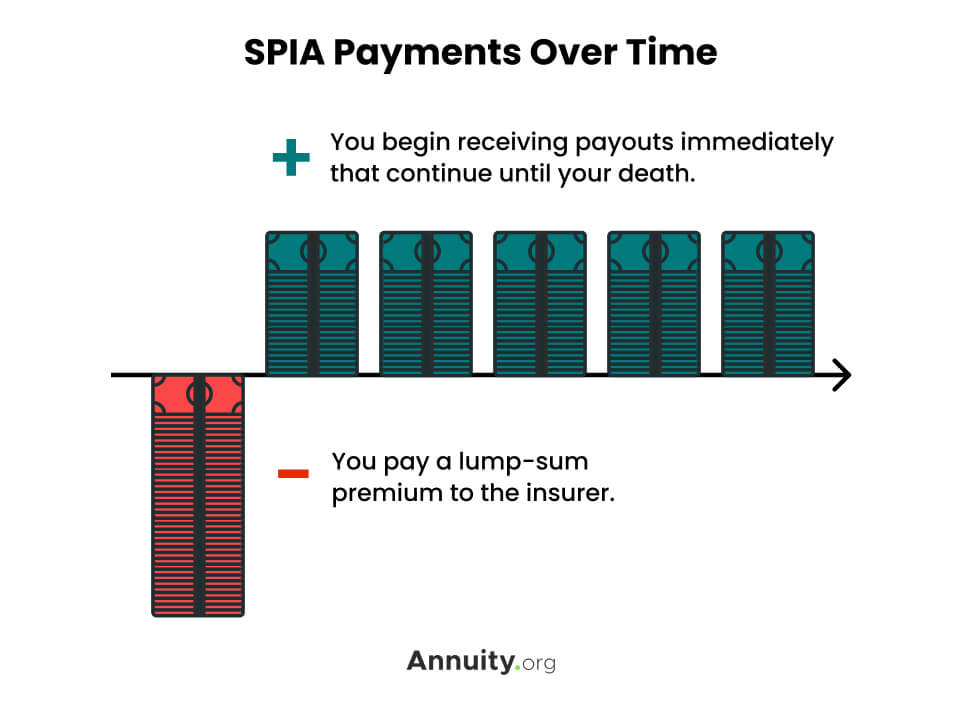

For an annuity to be considered an immediate annuity guaranteed income payments must begin within the first twelve months after purchase. If Sara chooses the single-life plan with a certain term of 10 years a payment of 1620 per month is guaranteed to be paid out for a minimum of 10 years and would. The income you receive from the annuity is guaranteed for the time period that you specify.

After the 10 years initial guarantee period you will have the option to either renew for another 10 year. Over the study period the. People ages 55 to 75 may benefit most from the guaranteed income of an annuity.

A 10-year term certain annuity payout means that payments are guaranteed to be made for at least 10 years. With sufficient income from other sources your spouse may not need guaranteed income from an annuity after you die. Define Single Life Only Annuity with 120-Month Guarantee.

For example if you purchase a single-life. A ten-year fixed annuity pays a guaranteed interest rate for 10 years. With a single life pension you can choose a lifetime monthly pension payment with.

For example suppose the annuity. If you die five years after you begin collecting the payments continue to your survivor for five more years. 10 Year Certain Single Life Annuity means a series of equal monthly payments for the life of the Participant with 10 years of guaranteed payments.

At the time of purchase you and an advisor will customize your income stream. Learn why annuities may not be a prudent investment for 500000 retirement portfolios. If you choose a guarantee period.

A guarantee period of 5 10 or 15 years If you die before the end of the period your beneficiaryies will receive your monthly pension for the remainder of the guarantee period. The single-year guarantee fixed annuity is like an adjustable rate mortgage in reverse. Annuities For Dummies.

For example life with a 10 year period certain is a common arrangement. Compare Live Annuity Rates From Over 25 Top Rated Companies. A life annuity with period certain annuity is a contract that guarantees payments for an annuitants entire life along with a guaranteed.

Ad Help Fund Your Retirement Goals with an Annuity from Fidelity. The two hypothetical participants are the same age and they select a single life annuity with a 10 year guarantee period using TIAAs Standard payout annuity. A guarantee period of 5 10 or 15 years.

Ad Help Fund Your Retirement Goals with an Annuity from Fidelity. Ad Get this must-read guide if you are considering investing in annuities. Older people in their late 70s and.

Your sex and spouses sex. What is a Life Annuity with Period Certain Annuity. Monthly incomes based on a premium of.

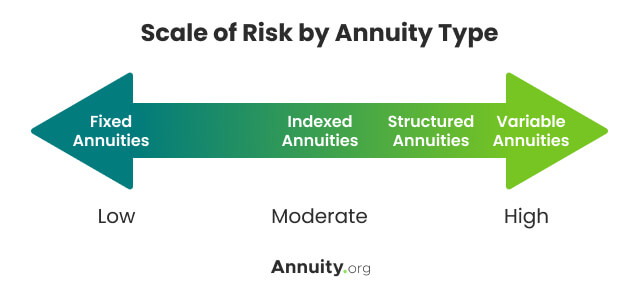

Ad Get The Most Income. The fixed indexed annuities have surrender charge periods between seven to 10 years and typically start with a 10 penalty and decrease by one percent each year.

Do You Really Need 8 Million Saved Up For Retirement Marketwatch Lifetime Income Do You Really Retirement

What Is A Single Life Annuity Due

Joint And Survivor Annuity The Benefits And Disadvantages

Single Life Annuity What Is A Single Life Annuity Lifeannuities Com

Life Insurance Vs Annuity How To Choose What S Right For You

Does An Annuity Plan Work For You Businesstoday Issue Date Mar 08 2020

What Is A Single Life Annuity Definition And Payout Option

Difference Between Immediate Annuity And Deferred Annuity Plans How To Plan Single Premium Annuity

What Is An Annuity Definition How Annuities Work Pros Cons

/CalculatingPresentandFutureValueofAnnuities1-0cea56f3b4514e44bed8f45d9c74011e.png)

Calculating Present And Future Value Of Annuities

Example Myga Fixed Annuity Statement And Purchase Experience My Money Blog Annuity Life Insurance Companies Lifetime Income

How A Single Life Annuity Will Impact Your Retirement Due

Period Certain Annuity What It Is Benefits And Drawbacks

Time To Start Thinking About Annuities Eckler

Time To Start Thinking About Annuities Eckler

Single Premium Immediate Annuity Spia Rates Pros Cons

Annuity Payout Options Immediate Vs Deferred Annuities

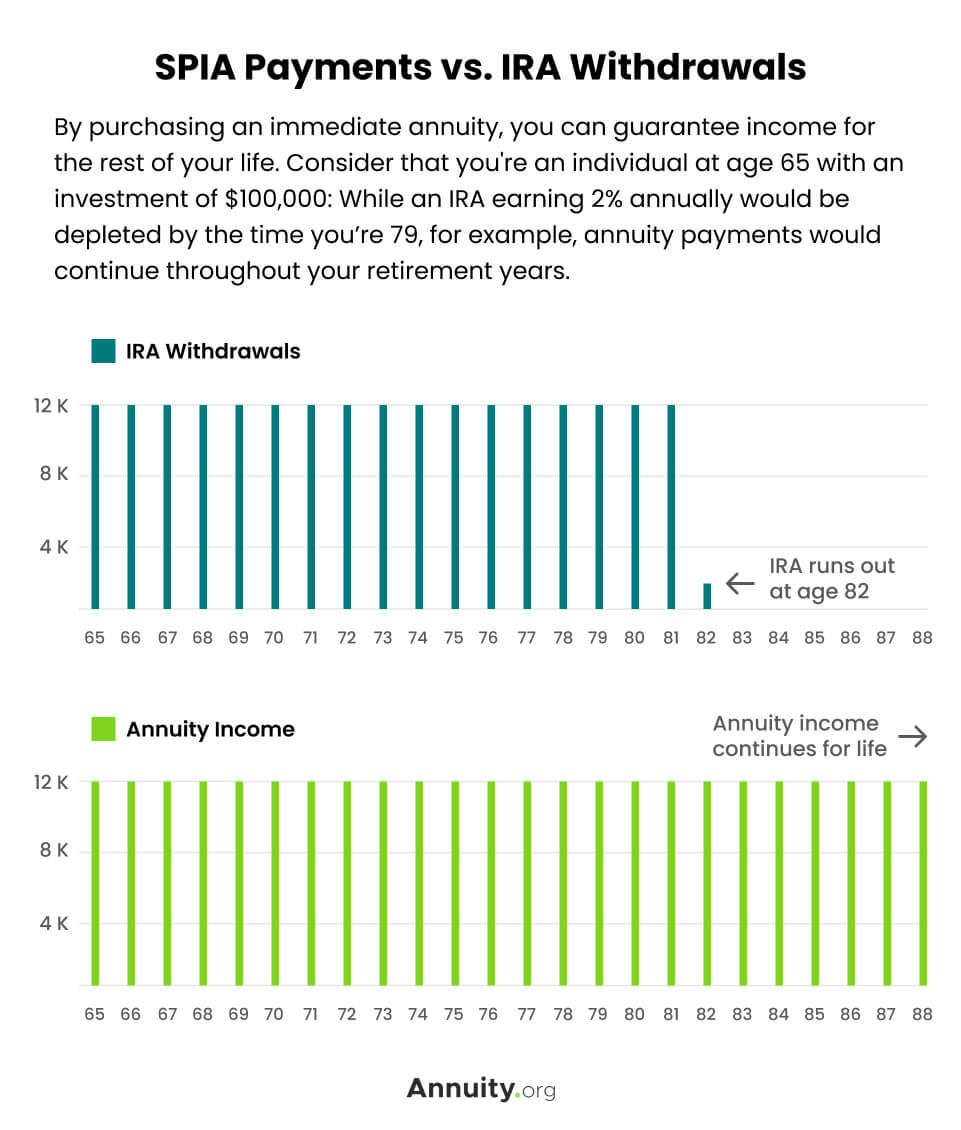

Single Premium Immediate Annuity Spia Rates Pros Cons

Professional Infographics With Quickturnaround Times Annuity Quotes Annuity Infographic